On October 26, the Second Circuit chucked out Argentina’s appeal against having to pay bond holdouts, having had “little difficulty concluding” that the defaulted debt’s dusty, old — but contractually standard — pari passu clause demanded rateable payment.

From that day forth, the world of restructuring sovereign debt – and writing sovereign debt contracts – was shaken. Maybe even changed forever. Certainly for the New York law part of that world, if not so much (or not yet) English law.

At the very least this might be considered an opportune moment to tweak the boilerplate sovereign pari passu clause. It is after all famously ambiguous, historically obscure, and the version at fault in the Second Circuit ruling is not a cross uniquely borne by the Republic of Argentina.

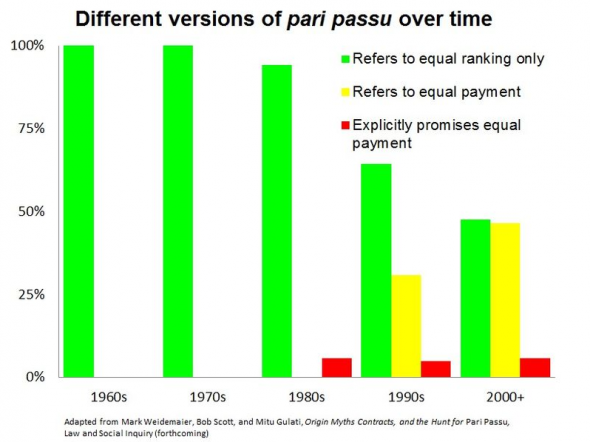

Chart via CreditSlips:

Well, who told these sovereigns…

Ivory Coast (November 30 reopening of 2032 bonds, governed by New York law):

The Securities are unsecured. The Securities constitute direct, general, unconditional and unsecured and unsubordinated obligations of the Republic ranking pari passu, without any preference among themselves with all other outstanding, unsecured and unsubordinated obligations, present and future, of the Republic.

Serbia (November 19 issue of 2017 bonds, governed by English law):

The Notes will constitute direct, unconditional and (subject to the provisions of a negative pledge covenant described below) unsecured obligations of the Issuer. The Notes rank and will rank pari passu among themselves and at least pari passu in right of payment with all other present and future unsecured obligations of the Issuer, save only for such obligations as may be preferred by mandatory provisions of applicable law. The full faith and credit of the Issuer is pledged to the due and punctual payment of all amounts due in respect of the Notes.

Mongolia (November 21 medium-term note programme, New York law):

The Notes and any relative Receipts and Coupons are direct, unconditional, unsubordinated and (subject to the provisions of Condition 4) unsecured obligations of the Issuer and rank and will rank pari passu, without preference among themselves, with all other unsecured and unsubordinated External Indebtedness (as defined in Condition 10) of the Issuer, from time to time outstanding.

Costa Rica (November 16 issue of 2023 bonds, New York law):

The Notes will constitute general, direct, unconditional and unsecured Public External Indebtedness of the Republic and will rank pari passu in right of payment, without any preference among themselves, with all unsecured and unsubordinated obligations of the Republic, present and future, relating to Public External Indebtedness of the Republic. The Republic has pledged its full faith and credit for the due and punctual payment of all amounts due in respect of the Notes.

Ukraine (November 26 issue of 2022 bonds, English law):

The Notes constitute direct, unconditional and, subject to the provisions of Condition 3 (Negative Pledge), unsecured obligations of the Issuer and (subject as aforesaid) rank pari passu without any preference among themselves. The payment obligations of the Issuer under the Notes shall rank at least pari passu with all other unsecured and unsubordinated obligations of the Issuer, present and future, save only for such obligations as may be preferred by mandatory provisions of applicable law.

Argentina (1994 Fiscal Agency Agreement, the “FAA bonds”, New York law):

The Securities will constitute (except as provided in Section 11 below) direct, unconditional, unsecured and unsubordinated obligations of the Republic and shall at all times rank pari passu and without any preference among themselves. The payment obligations of the Republic under the Securities shall at all times rank at least equally with all its other present and future unsecured and unsubordinated External Indebtedness (as defined in this Agreement).

Spot the differences.

That’s a selection of pari passu clauses in prospectuses for sovereign debt issued in the six weeks or so since the Second Circuit ruling. Plus, for reference, the clause in the original Argentine holdout debt.

We’re grateful to Mitu Gulati, law professor at Duke University, for gathering together these new bond issues. Gulati also makes a very interesting point: these clauses do not show sudden change. They are not markedly different to ones used before the Argentina litigation exploded on to the front pages.

What’s more, a few governments have even recycled the very ‘payments’ language which got Argentina into so much hot water with the Second Circuit. (Others’ clauses stick to somewhat blander – safer? – ‘ranking’ language, which could support a view that the clauses only promise equal legal ranking of creditors.)

In a ruling which every sovereign debt lawyer in the business would have carefully noted, the Second Circuit decided that the second, “payment obligations” sentence of the Argentine clause “prohibits Argentina, as bond payor, from paying on other bonds without paying on the FAA Bonds.” That is a challenge to the reigning “equal ranking” interpretation, and a potentially fatal chink in a defaulting sovereign’s armour. And it’s back in bond issues as if nothing had happened.

That’s pretty extraordinary.

But the real question is where this overall inertia in pari passu language is coming from. A bit like the pari passu clause itself, it is kind of a mystery. Or is it?

Maybe the sovereigns don’t want change.

Maybe they just like the way things have been done and drafted before, or dislike being associated with novelty. Ivory Coast was reopening an old bond, for example, while Mongolia and Costa Rica aren’t names you see in the market every day. Similarly, if those pari passu clauses bearing ‘ranking’-heavy wording aren’t obviously broke, why fix them? Holdout nastygrams featuring the pari passu clause might in general be seen as an abundantly acceptable risk, far off in the tail, for Mr or Ms Harassed Finance Minister. A government would have to blow up the economy and try to restructure its debt first. A tail risk all to itself.

Maybe the sovereigns therefore think they’re safe enough. When it comes to bearing holdout risk, it is worth noting that one or two of the sovereigns here who have issued with ‘payments’ pari passu language did so under English law and the exclusive jurisdiction of English courts.

There’s some speculation that an English judge would laugh a payment interpretation of pari passu right out of court. Informed speculation, based on these 2005 ruminations by the Financial Markets Law Committee. (The FMLC quite literally said English contract interpretation is far too common sense to tolerate silliness like this.) But then it remains only speculation: there has been no decisive English court ruling that turned on the meaning of pari passu. English courts sometimes throw up left-field judgements in debt restructuring. Meanwhile, what’s now being said about English courts used to be said about New York courts after a Belgian judge rewarded holdouts in Elliott v Peru at the turn of the century. Couldn’t happen here, until it happened.

Maybe the sovereigns trust in collective action clauses to preempt any holdout challenge, and thus pari passu dispute. There’s a number of the clauses dotted across these bonds’ terms. But then CACs aren’t holdout-proof.

Maybe the markets don’t want change. Investors took down Costa Rica’s bond in return for the country’s lowest ever borrowing cost. It is one of the bonds here which feature the ‘payment’ version of pari passu. Elliott and other holdouts would probably love to point to this kind of thing, as it would appear to show there’s no wider systemic problem with the way they want to get their money from Argentina.

But then we’re assuming sovereigns and markets are the main agents driving any change in pari passu wording. We’re not looking at the drafters themselves: law firms. They are the ones who have previously treated the clause as boilerplate, including it cookie-cutter-fashion across bond contracts despite – apparently – not really knowing where it comes from, how it got into sovereign debt, or what it means.

There is a curious (and slightly scary) hint here about how big law drafts financial contracts, which is pretty interesting beyond the pari passu saga. In fact, Mitu Gulati went and wrote an entire book on it with Robert Scott of Columbia law school. More on that, in a later post.

Related link:

Argentina’s (not so) unusual pari passu clause – Credit Slips

Argentina’s (not so) unusual pari passu clause – Credit Slips

Keine Kommentare:

Kommentar veröffentlichen