Dear Cleary Gottlieb (Argentina’s lawyers): good luck defending this one.

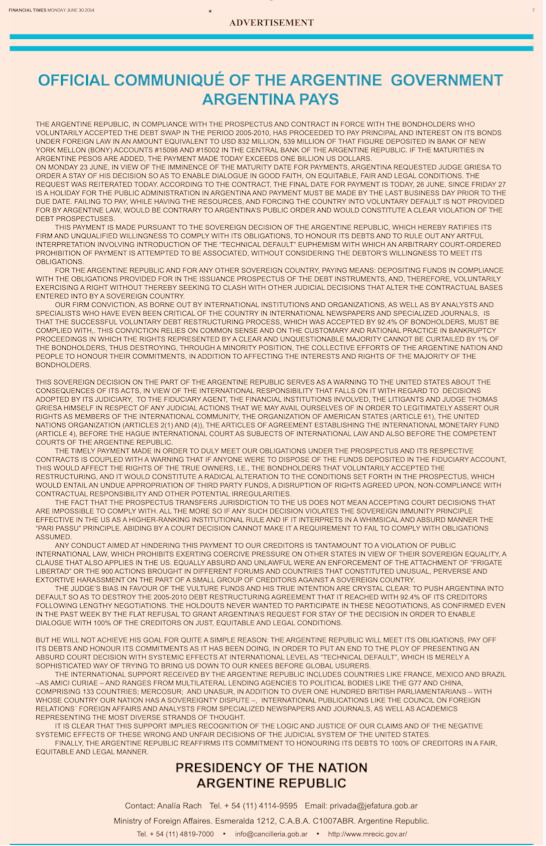

From page 7 of Monday’s dead-tree FT — Argentina’s announcement that it is about to default. Naturally, given the bizarro world of the pari passu saga, this announcement is headlined ARGENTINA PAYS. Click to enlarge:

Argentina doesn’t mention the grace period on the bonds. Anyway, this part in particular…

The judge’s bias in favour of the vulture funds and his true intention are crystal-clear: to push Argentina into default so as to destroy the 2005-2010 debt restructuring agreement…But he will not achieve his goal for quite a simple reason: the Argentine republic will meet its obligations, pay off its debts and honour its commitments as it has been doing, in order to put an end to the ploy of presenting an absurd court decision with systemic effects at international level as “technical default”, which is merely a sophisticated way of trying to bring us down to our knees before global usurers.

Argentina is saying all this just a few days after Judge Griesa ruled that its attempted payment of only the restructured bondholders was illegal, and that Bank of New York had to send it back. The judge also hoped negotiations would continue. This doesn’t make that any easier.

Although beneath the bluster, Argentina may have a plan here. It’s prepared to argue that any payment it tries to make is enough to fulfil its obligations to the restructured bondholders: if the payment doesn’t go through, it’s the system’s fault. We wonder if that’s going to become the republic’s main negotiating gambit: continuing to store up funds for the restructured payments in accounts in Argentina (so that bondholders know the money is waiting for them), and existing in this state of quasi-default. The holdouts for their part can’t let Argentina default and exit US jurisdiction.

It all feels a bit like playing Russian Roulette. With someone else’s head.

And meanwhile in the international consequences of this saga… holders of Argentina’s English-law and euro-denominated restructured debt have applied to Judge Griesa to exclude their payments from the pari passu injunction. Motion here, and letter to the judge here. Which agent of the global usurers is presently on holiday.

Keine Kommentare:

Kommentar veröffentlichen