Guest post: Venezuela’s Citgo and the revolution’s Praying Mantis School of Business

Investing in Venezuela has always been like praying mantis love. On first acquaintance, Bolivarian Venezuela has those big, beautiful Miss Venezuela eyes and those angelic clasped praying hands inspiring trust and confidence, all backed up by glorious profits and yields. But while other investors in Venezuela – from oil companies, to airlines, to consumer products corporations – have been lured to their demise, bondholders have until the past two years been spared from most praying mantis cannibalism, and the action for bondholders has been great! Even if Venezuela has not paid shareholders of ExxonMobil, ConocoPhillips, or the Koch brothers’ Fertinitro, Venezuela paid the bondholders handsomely! Always! But then came the first sign of trouble, from steel company Sidetur, which the Venezuela government expropriated in 2013 and then didn’t pay its bondholders (or shareholders).

Subsequently, over the past year, Venezuela bondholders have finally gotten their heads ripped off. Now the Praying Mantis School of Business is landing on American shores. (For those unacquainted with the sexual cannibalism of the praying mantis, you can watch a two-minute video here.)

In July, Citgo, the US refining subsidiary of PDVSA, Venezuela’s state oil group, issued $650m in new debt with seemingly strong covenants to protect bondholders. The first hint of doom should have been the identity of the lawyers who wrote Venezuela’s side of the Citgo bond offering memorandum – Curtis, Mallet-Prevost, Colt & Mosle. George Kahale III, Curtis Mallet’s chairman and former managing partner, is the ace in Venezuela’s arsenal and has been the Bolivarian Republic’s chief defender in its multitude of expropriation cases. The guy is better than good – he is the Red Baron of their legal defence.

The bond prospectus seems to have some pretty strong covenants to protect existing lenders and bondholders from just the sort of thing that Citgo is now trying to do:

The New Senior Credit Facility will also be governed by a financial covenant providing for an indebtedness to total capitalization ratio of no more than 60%, to be calculated on a consolidated basis and for each consecutive four fiscal quarter period.

Payments of Dividends. The New Senior Credit Facility will allow us to pay dividends equal to 100% of our cumulative net income (commencing from April 1, 2014 and excluding the aftertax effect of gain on sales of assets) plus net after-tax proceeds from certain permitted assets sales. The New Senior Credit Facility will prohibit us from paying dividends during the existence of an event of default and to the extent payment of dividends would trigger an event of default, and further restrict our payment of dividends by instituting a number of debt incurrence tests, including the following:

• minimum liquidity of $500 million post-dividend; and

• maximum indebtedness to total capitalization of 55% post-dividend.

Incurrence of Indebtedness. The New Senior Credit Facility will allow us to issue the notes offered hereby. In addition, the New Senior Credit Facility will allow us to issue up to $1,000 million in additional secured and unsecured indebtedness, a portion of which indebtedness may be incurred in the form of fixed rate IRBs. To the extent we issue additional secured indebtedness, it may share in the collateral securing the New Senior Credit Facility and the notes offered hereby on a pari passu basis. We currently have $108 million IRBs outstanding. All but $3 million of our outstanding IRBs will be secured on an equal and ratable basis by the collateral securing the notes and the New Senior Credit Facility.”

How is Venezuela able to get around these rules, which restrict the ability of PDVSA to dilute Citgo’s credit quality and the ring-fencing which includes a debt/cap maximum of 60 per cent, with a lower 55 per cent test for purposes of making distributions to the parent?

Two major moves:

1. They are taking PDV America, Inc and changing its name to Citgo Holding, Inc, which will issue the debt above Citgo Petroleum Corporation. Here is the ownership structure before the name change:

2. They are taking the terminals (East Chicago, Linden, Albany, Toledo and Dayton) and pipeline assets – which, though mentioned in the prospectus, were not security for the original bondholders – and getting them out from underneath the bondholders by borrowing billions in the name of this new holding company and selling the assets to their own new holding company for $750m as they suck out the money, since they are allowed to repatriate profits from sales of assets.

Previously, Venezuela was trying to sell Citgo but that looks to be effectively blocked by ongoing legal actions and threatened legal actions from creditors like ConocoPhillips (no judgment yet, but estimated at $4.5bn), ExxonMobil (has ICSID judgement for $1.7bn) and Gold Reserve (has ICSID judgment for $745m). Texas judge Caroline Baker has not yet ruled on ConocoPhillips Petrozuata’s discovery request on Citgo’s sale, where ConocoPhillips said it would try to prevent the proceeds of a Citgo sale from leaving the country, but the writing was on the wall and buyers are obviously worried about being caught up in years of legal wrangling.

So, because they owed so many people, they were unable to sell Citgo, which we had estimated could realize $5bn to $7bn when oil was at $100 a barrel. Instead, they are getting around bondholder and lender protections and sucking the money out of it by forming a new company called Citgo Holdings, Inc above existing bondholders and loading it up with new debt of $2.5bn, with “$1.5 billion as a high yield offering” and a “$1 billion senior secured first lien five-year term loan B.”

As of December 31, 2014, Citgo’s total debt was already $1.91bn.

In the new structure, Citgo Holding, Inc will own 100 per cent of Citgo as well as the new owner of five oil products terminals, Citgo Holding Terminals, plus two pipeline companies, Southwest Pipeline Holding and Midwest Pipeline Holding. During the last 12 months ended in September 2014, these assets generated just $40m in EBITDA – not even enough to pay half of the interest on the $1bn Term Loan B, much less the interest on a $1.5bn bond!

The new Term Loan B and the secured notes will only be guaranteed by the terminal and pipeline companies; Citgo is not a guarantor of the proposed transactions. As Moody’s notes:

The security package for the Term Loan B and the notes is weak as it will only include the terminals and pipelines to be acquired from Citgo plus 49% of the capital stock of Citgo.

Citgo Holding, Inc will also maintain a reserve account for the benefit of the creditors. The reserve account will be funded on the issue date with funds sufficient to cover one semi-annual interest payment on the debt; the issuer will be obligated to maintain at least such level in the reserve account until the maturity of the loan and the notes. Of course, Sidetur also had such a covenant, and Venezuela defaulted on that in 2013.

Citgo is having to offer over 10 per cent on the loan and is still not finding many takers. Current price talk is about 800 basis points over Libor on the five-year senior secured first-lien Term Loan B, according to lead manager Deutsche Bank. There is a Libor floor of 1 per cent – meaning that the interest paid on the principal would be at least 9 per cent – and it will be issued at a discount of 96–97 (ie not 100, par) to bring the yield above 10 per cent. Meanwhile, Venezuela and PDVSA debt is offering yields of as much as 63 per cent in two years and still having trouble finding takers.

As is apparent, Venezuela is starved for cash. The country must pay a total of $11bn in US dollar/euro maturities, amortization and interest this year. In February alone, Venezuela, PDVSA and Citgo have to pay over $750m in interest payments on bonds. In March, they have to retire the 1 billion euro Venezuela 7 per cent of 2015.

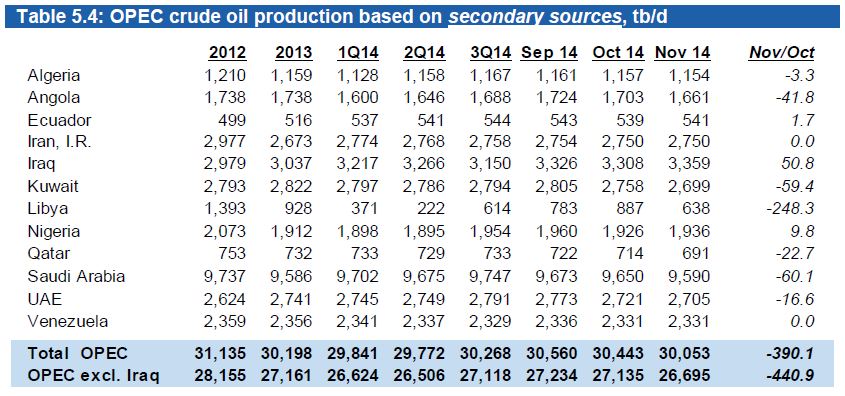

Venezuela’s oil basket averaged $39.52 a barrel this week. According to December’s Opec statistics, Venezuela is producing 2.33m barrels a day, but 800,000 barrels are used in domestic consumption, Cuba gets some free (it was 100,000), China was getting 450,000 barrels a day of their 650,000 in imports as payments toward the $50bn they have already loaned Venezuela. In short, Venezuela only realizes cash from 1.2m to 1.5m barrels a day. At 1.5m bpd at $39.52, it gets $59.3m a day, or $21.6bn for the year. For 1.2m bpd at $39.52, it is just $47m a day, or $17.3bn for the year – barely enough to cover the $11bn in debt, much less pay your oil providers, suppliers and personnel, not to mention imports and everything else.

Addendum – Maduro’s dog & pony show

One other thing: like many analysts and masochistic observers, I sat through the five hours of the Dog and Pony Show that was Maduro’s Annual Address to the National Assembly last Wednesday night. I must say that I had a moment of positive thought when the cameras showed banners of Maduro with China’s Xi Jinping – Maduro had promised to reveal all the details of all the money he had gotten on his Beg, Borrow or Steal Tour, so I thought “Oh, maybe he really did get the $20bn from China or maybe even the billions from the Qataris and he is going finally tell us about it! Wow!” So, what did Maduro say about the so-called billions he said he had gotten on his tour from China and Qatar? Nothing. Crickets. He said nothing at all. Almost like it had never really happened. Welcome to the Praying Mantis School of Business.

One other thing: like many analysts and masochistic observers, I sat through the five hours of the Dog and Pony Show that was Maduro’s Annual Address to the National Assembly last Wednesday night. I must say that I had a moment of positive thought when the cameras showed banners of Maduro with China’s Xi Jinping – Maduro had promised to reveal all the details of all the money he had gotten on his Beg, Borrow or Steal Tour, so I thought “Oh, maybe he really did get the $20bn from China or maybe even the billions from the Qataris and he is going finally tell us about it! Wow!” So, what did Maduro say about the so-called billions he said he had gotten on his tour from China and Qatar? Nothing. Crickets. He said nothing at all. Almost like it had never really happened. Welcome to the Praying Mantis School of Business.

Russ Dallen is managing partner of investment bank Caracas Capital Markets in Venezuela and publisher of the Latin American Herald Tribune.

Keine Kommentare:

Kommentar veröffentlichen