China Sets Up Gold Investment Fund For Central Banks

Submitted by GoldCore on 05/25/2015 09:19 -0400

- China’s new gold fund - 60 countries to develop gold mining projects

- Allow member central banks to have easier access to gold

- Gold to be traded on increasingly important Shanghai Gold Exchange

- Another important step in making yuan reserve currency

- China and Russia challenging U.S. dominance in key Eurasia

- New gold fund shows monetary importance placed on gold by China

- China ensuring supply in event West to East gold flows end

- Gold’s reemergence as important monetary asset both for individuals and powerful nations

- Allow member central banks to have easier access to gold

- Gold to be traded on increasingly important Shanghai Gold Exchange

- Another important step in making yuan reserve currency

- China and Russia challenging U.S. dominance in key Eurasia

- New gold fund shows monetary importance placed on gold by China

- China ensuring supply in event West to East gold flows end

- Gold’s reemergence as important monetary asset both for individuals and powerful nations

China has announced the establishment of a new international gold fund with over 60 countries as members. The large fund, which expects to raise 100 billion yuan or $16 billion, will develop gold mining projects across the economic region known as the New Silk Road.

President Xi Jinping said earlier this year he hoped annual trade with the countries involved in the increasingly important modern Silk Road would surpass $2.5 trillion in a decade.

According to Xinhua, the official Chinese news agency, the project will facilitate the central banks of member states to acquire gold for their reserves more easily. This may explain the broad support which the project has received in the area.

“About 60 countries have invested in the fund, which will in turn facilitate gold purchase for the central banks of member states to increase their holdings of the precious metal, according to the SGE.”

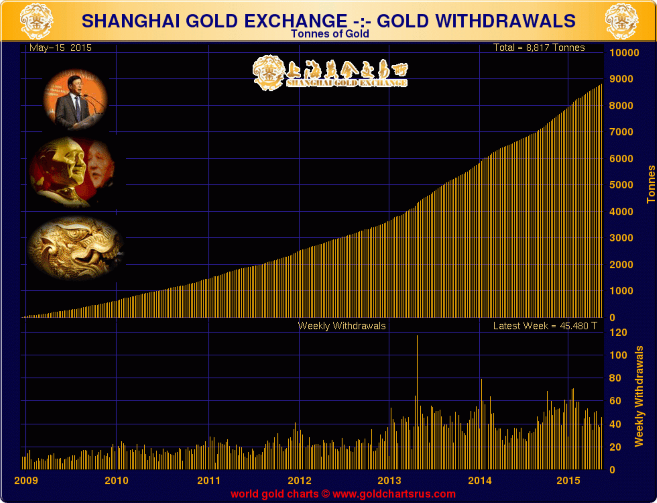

The project is being overseen by the Shanghai Gold Exchange (SGE) and it is likely that the newly mined gold will be either be traded on the SGE or be sold directly to the PBOC and other central banks.

Shanghai Securities News reported yesterday that two leading gold producers, Shandong Gold Group, the parent of Shandong Gold Mining Co Ltd, and Shaanxi Gold Group will take stakes of 35 percent and 25 percent respectively, with the rest owned by other unnamed financial institutions.

The fund's activities could take in the launch of gold-backed exchange-traded funds and buying stakes in listed gold companies and mining firms.

The new project marks another step forward in the internationalisation of the Yuan. Xinhua, which tends to represent the views of the Chinese government, quotes a spokesperson from the Industrial Fund Management Co. as saying

"China does not have a big say in gold pricing because it accounts for a small share of international gold trade,""Therefore, the Chinese government seeks to increase the influence of RMB in gold pricing by opening the domestic gold market to international investors."

Coupled with the BRICS bank and the AIIB, China's power in the region and internationally is strengthening. The China Gold Association is on record as saying that they aim to surpass Germany in the near future as the second largest holder of gold reserves - with 4,000 tonnes of gold. The PBOC’s sights are on the 8,500 tonne mark which is the amount of gold supposedly held by the U.S. - reserves unaudited for half a century.

Separately, the growing trend of western central banks attempting to repatriate their sovereign gold continues. Reports from Austria over the weekend say that the central bank of that country is set to repatriate a sizable proportion of its gold - the bulk of which is in the UK.

Reuters cites an Austrian National Bank report stating "around 80 percent is kept in Britain, 17 percent in Austria and 3 percent in Switzerland."

Austria's Krone newspaper claims that under the new plan "50 percent would be kept in Austria, 30 percent in Britain and 20 percent in Switzerland."

Central banks remain some of the biggest buyers of gold and yet gold buying remains small when compared to the huge foreign exchange reserves built up in the last 20 years.

For 17 consecutive quarters central banks have been net buyers of gold. 2014 saw central banks buying 477.2 tonnes of gold - the second highest volume in 50 years, second only to 2012. Western central banks are seeking to bolster their currencies by securing their gold reserves as the end game of unpayable gargantuan debt approaches.

The new order which is emerging out of Asia is one in which gold will clearly play a central role. The Chinese move may be designed to ensure a supply of gold in the event that a systemic or monetary crisis leads to a cut off in the massive flow of gold bullion from west to east seen in recent years.

Given the tiny size of the physical gold market, the Chinese are aware that there will likely come a time when physical gold bullion may be very hard to acquire - especially in the volumes that have been acquired by China in recent years.

Investors would be wise to pay heed to these important trends and gold’s reemergence as an important monetary asset both for individuals, central banks and powerful nations.

Must Read Bullion Guides below:

Essential Guide to Bullion Storage in SwitzerlandEssential Guide to Bullion Storage in Singapore

Essential Guide to Bullion Storage in SwitzerlandEssential Guide to Bullion Storage in Singapore

MARKET UPDATE

Today is a spring bank holiday in the UK and the U.S. is observing Memorial Day.

Friday’s AM LBMA Gold Price was USD 1,211.00, EUR 1,083.45 and GBP 772.96 per ounce.

Gold fell $0.10 to close at $1,204.30 an ounce Friday, and silver slipped $0.08 at $17.03 an ounce. Gold and silver finished down for the week at 1.6 percent and 2.6 percent

Friday’s AM LBMA Gold Price was USD 1,211.00, EUR 1,083.45 and GBP 772.96 per ounce.

Gold fell $0.10 to close at $1,204.30 an ounce Friday, and silver slipped $0.08 at $17.03 an ounce. Gold and silver finished down for the week at 1.6 percent and 2.6 percent

Overnight, gold in Singapore was down 0.1 percent at $1,204.46 an ounce near the end of day trading. Gold inched lower in dollars and pounds today but was higher in euros. The U.S. dollar gained to a one month high with help from better than expected U.S. consumer prices for April.

Trading will be thin today with low volumes because of the holiday in the U.S. and UK markets.

In a speech to a business group on Friday, Fed Chair Janet Yellen indicated that the U.S. central bank was poised to raise rates this year. Contrary to recent data, she claimed the U.S. was set to bounce back from an early-year slump and headwinds at home and abroad were waning.

Russia and Kazakhstan raised their gold holdings in April as the price of gold steadied, while Jordan entered as a steady buyer earlier this year, data from the IMF showed on Friday.

Russia increased its stocks by 8.333 tonnes to 1,246.625 tonnes in April, the data showed, buying for the second straight month after a pause for just one month this year. Kazakhstan raised its gold holdings by 2.441 tonnes to 200.851 tonnes last month.

Jordan, a small holder of gold reserves, became a buyer in the first quarter of this year, bringing its holdings to 33.28 tonnes in March, after raising them by 3.4 tonnes in January, 8.087 tonnes in February and 2.488 tonnes in March. This marks a 76% increase from the end of 2014.

In late morning European trading gold is off 0.14 percent at $1,203.97 an ounce. Silver is down 0.25 percent at $17.03 an ounce while platinum is up 0.28 percent at $1,146.57 an ounce.

Breaking News and Research Here

Keine Kommentare:

Kommentar veröffentlichen