Donald Trump has pledged to not "take even one dollar" of salary in his role as U.S. president.

That's good because a host of entities — from foreign banks to emerging-market companies and governments — might need the cash.

That's good because a host of entities — from foreign banks to emerging-market companies and governments — might need the cash.

Instead, the election of Trump sets the stage for a further balkanization of global money markets and an impediment to the free flow of trillions of dollars' worth of different currencies, including a curtailment of cross-border transactions and the possible end of currency swap lines offered by friendly central banks, the strategists argue.

"We expect de-globalization to negatively impact financial markets, particularly the availability of dollar funding," they write. "Reserve manager commercial bank dollar deposits are falling. Central bank swap lines can no longer be taken for granted. The potential repatriation of more than a trillion dollars of offshore U.S. corporate earnings could aggravate dollar funding pressure further."

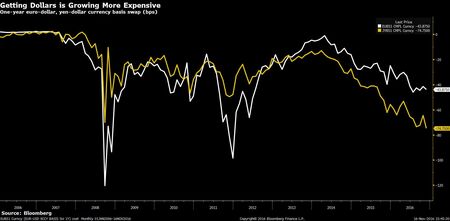

A confluence of post-crisis regulation, diverging monetary policies and money market reform is said to have restricted the availability of dollar funding, with the cost to convert local currency payments into dollars reaching its highest levels in about three years for both the euro and the Japanese yen — despite abundant levels of global liquidity. That trend could be made "permanent" under a Trump regime, Deutsche Bank says, as the President-elect's policies reduce the movement of capital around the globe and spark another round of cross-border deleveraging.

Source: Bloomberg

For instance Trump's plan to repatriate corporate profits to the U.S. could take a chunk out of the world's available dollar funding, since as much as $2 trillions' worth of corporate earnings currently sit outside country, according to Deutsche Bank's estimates. "A U.S. corporate tax holiday or even a simplification of the tax code to encourage repatriation would be most likely to impact the availability of dollar liquidity for European banks, where most U.S. corporate earnings have been re-invested," the analysts wrote.

While scarce dollar funding could be combated by central banks aiming to ease strains in the bowels of the financial system, Trump's populist rhetoric puts the availability of dollar swap lines from the Federal Reserve in doubt, according to Deutsche Bank. Such dollar swap lines, in which central banks agree essentially to swap currencies with each other, saw the Fed provide some $600 billion worth of dollar liquidity during the 2008 financial crisis.

"In a world of rising protectionism and anti-globalization sentiment it is doubtful that the commitment to such facilities can be taken for granted in the future," Deutsche Bank concluded. "The provision of dollar liquidity caused material political backlash in the U.S. during 2008 and tolerance from a Trump-led administration is likely to be even smaller."

"In a world of rising protectionism and anti-globalization sentiment it is doubtful that the commitment to such facilities can be taken for granted in the future," Deutsche Bank concluded. "The provision of dollar liquidity caused material political backlash in the U.S. during 2008 and tolerance from a Trump-led administration is likely to be even smaller."

Keine Kommentare:

Kommentar veröffentlichen